Rúnda a bheith rathúil i trádála Forex coinnigh tú féin suas chun dáta leis na Straitéisí is déanaí sa mhargadh. táimid chun roinnt Straitéisí Simplí ach is Fearr a Nochtadh le haghaidh brabús comhsheasmhach a oibríonn do thosaitheoirí. Cuidíonn na leideanna agus cleasanna trádála forex seo leat an Riosca a íoslaghdú. Bainimid úsáid as Ár nAcmhainní is Fearr chun na leideanna rúnda seo a sholáthar duit.

Straitéisí Trádála Forex Chun Tuiscint Níos Fearr Ar Forex

Ní éacht éasca é plean gnó tine cinnte a chruthú i dtimpeallacht airgeadais an lae inniu. Beidh ort a bheith ag obair go dian chun gnó baile a thosú ón talamh aníos. Feiceann go leor daoine malairt eachtrach mar bhealach eile chun airgead a dhéanamh lasmuigh den fhostaíocht thraidisiúnta. Is féidir leat brabús a dhéanamh freisin má léann tú na leideanna thíos.

Tá Forex ag brath níos mó ar choinníollacha eacnamaíocha ná ar an rogha, trádála todhchaíochtaí nó an stocmhargadh. Má tá tú eolach ar mhíchothromaíochtaí trádála agus cúrsaí airgeadais eile lena n-áirítear rátaí úis, is mó an seans go n-éireoidh leat le malairt eachtrach. Beidh caillteanais mhóra airgeadais mar thoradh ar thrádáil gan eolas ar na fachtóirí ríthábhachtacha seo.

Níor cheart duit trádáil a dhéanamh riamh faoi bhrú agus ag mothú mothúchánach. Mothúcháin cosúil le saint, féadann fearg agus scaoll a bheith ina chúis le roghanna trádála uafásacha a dhéanamh. Cé go mbeidh tionchar dosheachanta ag do mhothúcháin ar do chinntí ar bhealach beag, ná lig dóibh a bheith mar phríomhspreagthóir. Déanfaidh sé seo do straitéis trádála a scrios agus cosnóidh sé airgead duit.

Forex ag brath ar an ngeilleagar níos mó ná margaí eile. Sula dtosaíonn tú ag trádáil forex, tá roinnt téarmaí bunúsacha cosúil le heasnaimh chuntais, míchothromaíochtaí trádála, agus beartas fioscach, go gcaithfidh tú a thuiscint. Má thosaíonn tú ag trádáil go dall gan tú féin a oiliúint, d’fhéadfá a lán airgid a chailleadh.

Is í an fhadhb atá ann go n-éiríonn le daoine gnóthachain agus go dtosaíonn siad ag fáil ego ionas go ndéanann siad rioscaí móra ag smaoineamh go bhfuil an t-ádh leo go mbainfidh siad buaiteoir. Is féidir an toradh céanna a bheith ar imní agus ar mhothúcháin scaoll. Ná déan cinntí bunaithe ar mhothúcháin, bain úsáid as do chuid eolais bailithe.

Is rogha infheistíochta casta é Malartú Eachtrach ar cheart a bheith dáiríre agus ní mar chaitheamh aimsire. Is cinnte go bhfuil daoine a bhfuil suim acu ann le haghaidh spraoi ag fulaingt. Bheadh na daoine seo níos oiriúnaí do chearrbhachas i gceasaíneo.

Marcóirí Stop Caillteanas

Níor cheart mothúcháin a úsáid riamh chun cinntí trádála a dhéanamh. Aon fhreagra mhothúchánach láidir, fearg san áireamh, eagla, saint, agus fervor, cur isteach ar do chumas trádáil go freagrach. Tá sé dodhéanta mothúcháin a bhaint go hiomlán as an gcothromóid, ach más iad príomhthiománaí do chinntí trádála, tá tú i dtrioblóid.

Ceapann go leor go bhfuil marcóirí stad-chaillteanas le feiceáil ar an margadh. Tá sé seo bréagach, agus má tá tú ag trádáil gan úsáid a bhaint as marcóirí stad-caillteanas, tá tú ag cur tú féin i mbaol ollmhór.

Anois, ní mór duit a thuiscint go mbeidh go leor iarracht ag teastáil ó thaobh trádála le Forex. Díreach toisc nach bhfuil tú ag díol rud éigin per se, ní chiallaíonn sé sin go bhfaigheann tú turas éasca. Ná déan dearmad díriú ar na leideanna a d’fhoghlaim tú thuas, agus iad a chur i bhfeidhm nuair is gá ionas go n-éireoidh leo.

Straitéisí Chun Do Trádála Forex a Dhéanamh Éasca Agus Éifeachtach

Déan trádáil a phlé le daoine eile sa mhargadh, ach bí cinnte do bhreithiúnas a leanúint ar dtús. Cé gur chóir duit a admháil cad atá le rá ag daoine eile, ná déan cinntí as a gcuid focal amháin.

Ba cheart do thosaitheoirí sa mhargadh malairte eachtraí a bheith aireach maidir le trádáil má tá an margadh tanaí. Má roghnaíonn tú margadh tanaí, is lú an seans go mbainfidh tú brabús.

Féach ar an nuacht gach lá agus bí aireach go háirithe nuair a fheiceann tú tuairiscí faoi thíortha a úsáideann d’airgeadraí. Rachaidh airgead suas agus síos nuair a labhraíonn daoine faoi agus tosaíonn sé le tuairiscí sna meáin. Bain triail as córas a bhunú a sheolfaidh téacs chugat nuair a tharlaíonn rud éigin sna margaí a bhfuil baint agat leo.

Cuidíonn rud éigin a chleachtadh leat éirí níos fearr air. Má úsáideann tú cuntas taispeána, is féidir tuairim a bheith agat cad ba cheart a bheith ag súil leis gan an riosca airgeadais a ghlacadh. Tá an t-idirlíon lán de ranganna teagaisc chun tú a chur ar bun. Sula ndéanfaidh tú do thrádáil fhíordhomhanda tosaigh, ba chóir duit gach rud is féidir a dhéanamh chun faisnéis a fháil agus tuiscint mhaith a bheith agat ar an bpróiseas.

Féach ar na cairteacha atá ar fáil chun an margadh Forex a rianú. Le teicneolaíocht an lae inniu, féadfaidh tú gluaiseachtaí mionsonraithe sa mhargadh malairte eachtraí a fháil i gceann 5 nóiméad agus 15 nóiméad. Fadhb amháin, áfach, le timthriallta gearrthéarmacha is ea an luaineacht fhiáin sa mhargadh, rud a fhágann go bhfuil mí-ádh randamach air. Is féidir leat strus agus sceitimíní neamhréadúla a sheachaint trí cloí le timthriallta níos faide ar Forex.

Tá roinnt rudaí is féidir leat a dhéanamh faoi thrádáil i forex. Tá sé intuigthe má tá leisce ort tosú. Cibé an bhfuil tú díreach ag tosú, nó tá siad tosaithe ag trádáil cheana féin, is féidir na leideanna atá foghlamtha agat anseo a úsáid chun do leasa. Ná déan dearmad - tá eolas ríthábhachtach, mar sin coinnigh suas chun dáta i gcónaí le faisnéis nua. Déan cinntí soladacha bunaithe ar do chuid eolais, na cairteacha agus do straitéis. Infheistiú go ciallmhar i gcónaí.

Do thosaitheoirí, déan do chuid infheistíochtaí forex a chosaint agus ná trádáil i margadh tanaí. De ghnáth ní bhíonn mórán suime ag an bpobal i margadh tanaí.Féach ar thuar Forex

Rúin Malairte Eachtraí i Forex By Trade Masterminds

Féach ar agus taighde a dhéanamh ar an nuacht airgeadais ós rud é go bhfuil tionchar díreach aige ar thrádáil airgeadra. De ghnáth bíonn tuairimíocht iontach ag an nuacht a chabhróidh leat ardú agus titim airgeadra a mheas. Ní mór duit roinnt seirbhísí ríomhphoist nó seirbhísí téacsála a shocrú chun an nuacht a fháil ar dtús.

Níos mó ná an margadh stoc, roghanna, nó fiú trádáil todhchaíochtaí, Tá forex ag brath ar choinníollacha eacnamaíocha. Sula dtosaíonn tú ag trádáil le forex, déan cinnte go dtuigeann tú rudaí mar éagothroime trádála, easnaimh sa chuntas reatha agus rátaí úis, chomh maith le beartas airgeadaíochta agus fioscach. Nuair nach bhfuil a fhios agat cad atá le déanamh, is bealach maith é chun teip.

Téigh trí thuairiscí nuachta faoi na hairgeadraí ar a bhfuil tú ag díriú agus cuir an t-eolas sin isteach i do straitéisí trádála. Tá lámh mhór ag an tuairimíocht maidir le treo an airgeadra a thiomáint, agus is gnách go mbíonn an nuacht freagrach as diatribe amhantrach. Chun cabhrú leat fanacht ar bharr na nuachta, liostáil le foláirimh téacs nó ríomhphoist a bhaineann le do mhargaí.

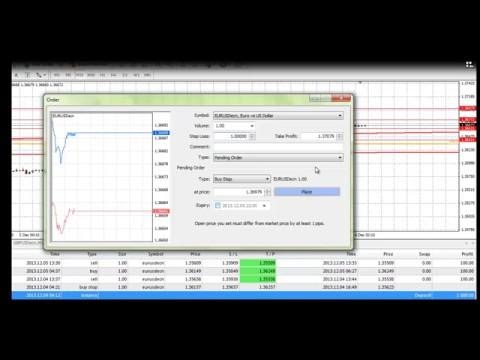

Tá sé tábhachtach dhá chuntas trádála ar leith a bheith agat nuair a thosaíonn tú ar dtús. Is cuntas tástála é ceann amháin ar féidir leat imirt agus foghlaim leis, is é an ceann eile do chuntas trádála fíor.

Bí cúramach i gcónaí agus corrlach á úsáid agat; is féidir leis an difríocht idir brabús agus caillteanas a chiallaíonn. Tá an cumas ag corrlach do bhrabúis a mhéadú go mór. ach, má úsáidtear go míchúramach é, is féidir le corrlach a bheith ina chúis le caillteanais a sháraíonn aon ghnóthachain ionchasacha. Is fearr corrlach a úsáid ach amháin nuair a bhíonn do shuíomh cobhsaí agus go bhfuil riosca an easnaimh íseal.

Ordú Stop

Níos mó ná aon mhargadh airgeadais eile, bogann forex leis na coinníollacha eacnamaíocha reatha. Éilíonn trádáil ar an margadh malairte eachtraí eolas ar bheartas fioscach agus airgeadaíochta agus ar chuntais reatha agus chaipitil. Gan na rudaí riachtanacha seo a bheith ar eolas agat, teipfidh ort.

Úsáideann trádálaithe Forex ordú stad mar bhealach chun caillteanais ionchasacha a theorannú. Placing a stop order will put an end to trades once the amount invested falls below a set amount.

If you are a newcomer to the foreign exchange market, be careful not to overreach your abilities by delving into too many markets. Spreading yourself too thin like this can just make you confused and frustrated. Try to stick with one or two major pairs to increase your success.

Foreign Exchange Trading

When looking for forex market trends, remember that, even though the market moves up and down, one movement is always more consistent than the other, creating a directional trend. It is simple and easy to sell the signals in up markets. When deciding on which trades to be involved in, you should base your decision on current trends.

Níor cheart duit a bheith ag súil le cur chuige iomlán nua a chruthú maidir le trádáil malairte eachtraí. Glacann saineolaithe airgeadais go leor ama agus fuinnimh ag cleachtadh agus ag déanamh staidéir ar thrádáil malairte eachtraí toisc go bhfuil sé an-, an-chasta. Ní dócha go dtiocfaidh tú trasna ar an straitéis trádála foirfe gan an t-am a ghlacadh ar dtús chun an córas a fhoghlaim. Éirigh leat féin chun na leabhair a bhualadh agus foghlaim faoi na straitéisí trádála a bhfuil taifid teiste cruthaithe acu.

Má tá a dhóthain fios agat conas, is féidir leat a lán airgid a dhéanamh. ach, do anois, ba cheart duit na leideanna ón alt seo a chur i bhfeidhm chun beagán airgid breise a thuilleamh isteach i do chuntas bainc.

Gach rud a theastaíonn uait a bheith ar eolas agat agus tú ag trádáil i Forex

After you have selected an initial currency pairing, study everything you can about it. Resist the urge to overwhelm yourself with too much information about pairings that you are not yet engaged in. Pick a currency pair you want to trade. Break the different pairs down into sections and work on one at a time. Pick a pair, read up on them to understand the volatility of them in comparison to news and forecasting.

To do good in foreign exchange trading, share experiences with other trading individuals, but be sure to follow your personal judgment when trading. What others have to say about the markets is certainly valuable information, but don’t let them decide on a course of action for you.

For a successful Forex trading experience, listen to what other traders have to say, but make your decisions based on your own best judgment. While it can be helpful to reflect on the advice that others offer you, it is solely your responsibility to determine how to utilize your finances.

Always be aware whenever you’re trading in Forex that certain market patterns are clear, but keep in mind one market trend is usually dominant over the other. It is fairly easy to identify entry and exit points in a strong, upward-trending market. Use the trends you observe to set your trading pace and base important decision making factors on.

Ba chóir do dhuine ar bith atá díreach ag tosú ar Forex fanacht amach ó thrádáil tanaí an mhargaidh. Is margaí tanaí iad siúd nach bhfuil mórán suime acu i súile an phobail.

Tá cairteacha ag Malartú Eachtrach a scaoiltear ar bhonn laethúil nó ceithre huaire. Mar gheall ar éascaíocht na teicneolaíochta sa lá atá inniu ann, is féidir leat súil a choinneáil ar Forex go héasca faoi cheathrú uair an chloig. ach, athraíonn na tréimhsí beaga seo go mór. Is féidir leat go leor den strus agus den chorraíl a sheachaint trí thimthriallta gearrthéarmacha a sheachaint.

Ní leor cuntas trádála amháin a bheith agat. Bain úsáid as cuntas amháin chun torthaí réamhamhairc do chinntí margaidh a fheiceáil agus an ceann eile chun do thrádáil iarbhír a dhéanamh.

Stop Caillteanas

Síleann roinnt daoine go bhfuil na caillteanais stad a shocraíonn siad le feiceáil ag daoine eile sa mhargadh. They fear that the price will be manipulated somehow to dip just below the stop loss before moving back up gain. Not only is this false, it can be extremely foolish to trade without stop loss markers.

The foreign exchange currency market is larger than any other market. It is in the best interest of investors to keep up with the global market and global currency. Trading foreign currency without having the appropriate knowledge can be precarious.

People tend to be get greedy once they start seeing the money come in. This can make them overconfident in their subsequent choices. Fear of losing money can actually cause you to lose money, as well. Control your emotions.

Can Traveling The World Can Help In Forex Trading Pro Tips

The foreign exchange market is more affected by international economic news events than the stock futrues and options markets. Before engaging in Forex trades, learn about trade imbalances, interest rates, fiscal and monetary policy. If you do not understand these before trading, you could lose a lot.

For a successful Forex trading experience, listen to what other traders have to say, but make your decisions based on your own best judgment. Take all the free advice you can get, but in the end, make decisions that follow your own instincts.

Research specific currency pairs prior to choosing the ones you will begin trading. You can’t expect to know about all the different types of pairings because you will be spending lots of time learning instead of actually trading. Pick your pair, read about them, understand their volatility vs. news and forecasting and keep it simple. Focus on one area, learn everything you can, and then start slowly.

Avoid choosing positions just because other traders do. Successes are widely discussed; ach, failures are usually not spoken of by foreign exchange traders. It makes no difference how often a trader has been successful. He or she is still bound to fail from time to time. Learn how to do the analysis work, and follow your own trading plan, rather than someone else’s.

Investing in the foreign market through Forex is a serious venture. Anyone who trades Foreign Exchange and expects thrills are wrong. Those who think that Forex is a game might be better going to the casino with their money.

It is important to set goals and see them through. When you start off in forex trading, make sure to make goals and schedules for yourself. Always remember that mistakes are a part of the process, especially if you are a beginner trader. Counting research, you should determine how much time can be used for trading.

If you want to become an expert Forex trader, don’t let emotions factor into your trading decisions. Emotions will cause impulse decisions and increase your risk level. It’s fine to feel emotional about your trading. Just don’t let emotions make your decisions.

Don’t go into too many markets when trading. This will just get you confused or frustrated. Instead, focus on the major currency pairs, which will increase your chances of success, and help you to feel more confident in your abilities.

Foreign Exchange

There are many decisions to be considered if you wish to begin trading in foreign exchange. Understandably, some individuals might hesitate starting an investment in Foreign Exchange. ach, if you are prepared, or are already trading, this advice will help. Keep getting the most current knowledge available. Make wise choices when spending money. Be smart about your investment choices.

When trading on Forex, you should look for the up and down patterns in the market, and see which one dominates. It is simple and easy to sell the signals in up markets. Select the trades you will do based on trends.

Tips To Maximize Your Forex Trading Success

Níor cheart go rialódh do mhothúcháin do iompar trádála Forex. Má tá tú ag trádáil bunaithe ar saint, fearg, nó scaoll, is féidir leat a fhoirceannadh i go leor trioblóide. Tá sé dodhéanta mothúcháin a bhaint go hiomlán as an gcothromóid, ach más iad príomhthiománaí do chinntí trádála, tá tú i dtrioblóid.

Fíor-airgead a chur i mbaol

Coinnigh ar an eolas faoi fhorbairtí reatha, go háirithe iad siúd a d'fhéadfadh tionchar a bheith acu ar luach na bpéirí airgeadra a bhfuil tú ag trádáil. Beidh an tuairimíocht i gcónaí rampant nuair a thagann sé chun trádáil, but the best way to keep updated with what’s going on is to keep your ears and eyes on the news. Set up text or email alerts to notify you on your markets so you can capitalize quickly on big news.

Trading practice will make good profits over time. These accounts will let you practice what you have learned and try out your strategies without risking real money. Take advantage of online tutorials! Know as much as you can before you start risking real money.

Make use of the charts that are updated daily and every four hours. Improvement in technology and communication has made Foreign Exchange charting possible, even down to 15-minute intervals. Ar an drochuair, the smaller the time frame, the more erratic and hard to follow the movements become. You do not need stress in your life, stay with long cycles.

Switch up your position to get the best deal from every trade. Some traders do this, and they often use more money than they need to. Adjust your position to current market conditions to become successful.

Especially if you are new to forex trading, it is important that you steer clear of thin markets. A “thin market” is defined as a market to which few people pay attention.

Choosing your stops on Forex is more of an art form than a science. You need to learn to balance technical aspects with gut instincts to be a good trader. It takes years of practice and a handful of experience to master foreign exchange trading.

If you’re thinking of buying a Forex robot or ebook because it comes with a get-rich-quick guarantee, save your money. Such products are based on trading strategies that are, at best, untested. You will most likely not profit from these products and instead provide money to the marketers of the products. Your money will be better spent if you use it to pay a successful Foreign Exchange trader for one-on-one lessons.

Anois, you need to understand that trading with Foreign Exchange is going to require a lot of effort on your part. Díreach toisc nach bhfuil tú ag díol rud éigin per se, ní chiallaíonn sé sin go bhfaigheann tú turas éasca. Ná déan dearmad díriú ar na leideanna a d’fhoghlaim tú thuas, agus iad a chur i bhfeidhm nuair is gá ionas go n-éireoidh leo.

Using margin wisely will help you retain profits. Good margin awareness can really make you some nice profits. Carelessly using margin can lose you more than what your profits would have been. Is fearr corrlach a úsáid ach amháin nuair a bhíonn do shuíomh cobhsaí agus go bhfuil riosca an easnaimh íseal.See Latest Forex Rates

Forex Foreign Exchange Secret Tips That You Need To Learn Immediately

Forex, a shortening of “foreign exchange,” is a currency trading market in which investors convert one currency into another, ideally profiting from the trade. Mar shampla, an investor in the United States purchased Japanese yen, but now believes the yen is becoming weaker than the U.S. dollar. If his charts are accurate and the yen really is weakening, making the trade will make him money.

Pay special attention to financial news happening regarding the currencies in which you are trading. The news contains speculation that can cause currencies to rise or fall. Chun cabhrú leat fanacht ar bharr na nuachta, liostáil le foláirimh téacs nó ríomhphoist a bhaineann le do mhargaí.

You should remember that the foreign exchange market patterns are clear, but it is your job to see which one is more dominant. It’s easy to sell a signal in up markets. Choose the trades you make based on trends.

Pay close attention to the financial news, especially the news that is given about the different currencies in which you are trading. Speculation is the name of the game, and the newsmedia has a lot to do with that. Capitalize on major news quickly by getting text or email alerts for markets in which you are interested.

Do not start trading Foreign Exchange on a market that is rarely talked about. Thin markets are those that lack much public interest.

People tend to be greedy and careless once they see success in their trading, which can result in losses down the road. Not keeping your cool and panicking can also lose you money. It is important to keep your emotions under control and act based on knowledge, not a feeling that you are experiencing.

Using margins properly can help you to hold onto more of your profits. Using margin can potentially add significant profits to your trades. ach, if it is used improperly you can lose money as well. Margin should only be used when you are financially stable and the risks are minimal.

Other people can help you learn trading strategies, but making them work is up to you following your instincts. Advice from others can be helpful, but you have to be the one to choose your investments wisely.

The foreign exchange market provides a wealth of information. Your broker should provide you with daily and four-hour trend charts that you should review before making any trades. Using charts can help you to avoid costly, spur of the moment mistakes. One potential downside, though, is that such short time frames tend to be unpredictable and cause traders to rely too heavily on sheer accident or good fortune. Try to limit your trading to long cycles in order to avoid stress and financial loss.

The foreign exchange market is arguably the largest market across the globe. This bet is safest for investors who study the world market and know what the currency in each country is worth. With someone who has not educated themselves, there is a high risk.

Great Ideas To Make The Most Of Your Forex Trading with Low Risk

While it is possible to make a profit with foreign exchange, it is important to learn about it first. Play around with the demo account until you become comfortable in the market. To make the most of your demo account, this article offers some tips to maximize your learning experience.

You should remember to never trade based on your emotions. Feelings of greed, excitement, or panic can lead to many foolish trading choices. While some excitement or anxiety is inevitable, you always want to trade with a sensible goal in mind.

Trading with your feelings is never a solid strategy in regards to Foreign Exchange trading. This will decrease your chances of making a bad choice based on impulse. While your emotions always impact the way you conduct business, it is best to approach trading decisions as rationally as possible.

Pay special attention to financial news happening regarding the currencies in which you are trading. Speculation based on news can cause currencies to rise and fall. Consider implementing some sort of alert system that will let you know what is going on in the market.

Foreign Exchange

Ná roghnaigh riamh do phost sa mhargadh malairte eachtraí bunaithe ar fheidhmíocht trádálaí eile amháin. Cuimhnigh go raibh teipeanna ag gach trádálaí malairte eachtraí a bhfuil taithí aige nó aici freisin, ní hamháin rath iomlán. Is féidir le gach trádálaí a bheith mícheart, is cuma a dtaifead trádála. Cloí le do chuid comharthaí agus clár, ní trádálaithe éagsúla eile.

Trading practice will make good profits over time. Mar novice, cabhróidh sé seo leat tuiscint a fháil ar an margadh agus ar an gcaoi a n-oibríonn sé gan an riosca a bhaineann le d'airgead tirim tuillte a úsáid. Tá go leor ceachtanna ar líne ar féidir leat a úsáid chun lámh in uachtar a fháil. Sula dtosaíonn tú ar do chéad trádáil, cruinnigh an t-eolas ar fad is féidir leat.

Níor cheart duit trádáil bunaithe ar mhothúchán riamh. Ní bheidh ach trioblóid mar thoradh ar ligean do mhothúcháin láidre a rialú. Cruthaigh spriocanna agus pleananna fadtéarmacha ionas gur féidir leat rath trádála.

Stad Cothromais

Traders use equity stop orders to limit their risk in trades. The equity stop order protects the trader by halting all trading activity once an investment falls to a certain point.

Once you have developed your strategies and learned the ins and outs of the market, you should be able to make some significant profits. Keep in mind that you should keep your knowledge sharp and current as things evolve. Continue to go through foreign exchange websites, and stay on top of new tips and advice in order to stay ahead of the game in foreign exchange trading.

Set up at least two different accounts in your name to trade under. You want to have one that is for your real trading and a demo trading account that you play around with to test the waters.

Trying To Improve Your Forex Skills? Must Read Below!

As you can see, Forex is a big world complete with all kinds of techniques, trades and more. The sheer size and competitiveness of the market can make it difficult to begin trading. The advice in this article will help you to figure it all out.

Watch the news and take special notice of events that could affect the value of the currencies you trade. News items stimulate market speculation causing the currency market to rise and fall. You should set up digital alerts on your market to allow you to utilize breaking news.

Forex trading depends on worldwide economic conditions more than the U.S. stock market, options and futures trading. Learn about account deficiencies, míchothromaíochtaí trádála, interest rates, fiscal and monetary policies before trading in forex. Without a firm grasp of these economic factors, your trades can turn disastrous.

Experience is the key to making smart forex decisions. Using demos to learn is a great way to understand the market. There are also many websites that teach Forex strategies. Learn the basics well before you risk your money in the open market.

You should avoid trading within a thin market if you are new to forex trading. Thin markets are markets that do not have a great deal of public interest.

Too many trading novices get overly excited and greedy when they are just starting out, causing them to make careless, sometimes devastating decisions. The same thing can happen when a person panics. Work hard to maintain control of your emotions and only act once you have all of the facts – never act based on your feelings.

Careful use of margin is essential if you want to protect your profits. Used correctly, margin can be a significant source of income. ach, má úsáidtear go míchúramach é, it can lose you more than might have gained. It is important to plan when you want to use margin carefully; make sure that your position is solid and that you are not likely to have a shortfall.

Traders use equity stop orders to decrease their trading risk in forex markets. If you have fallen over time, this will help you save your investment.

In the world of forex, there are many techniques that you have at your disposal to make better trades. The world of forex has a little something for everyone, but what works for one person may not for another. Hopefully, these tips have given you a starting point for your own strategy.

You’re Going To Really Like These Foreign Exchange Advice

Forex makes no attempt at concealing its massive size and complexities, but continues to offer enough reward to balance the scales perfectly. Navigating your way to a successful trading strategy in this competitive marketplace can feel a little daunting at first. These tips can lead you in the right direction.

Learn about the currency pair once you have picked it. If you attempt to learn about the entire system of foreign exchange including all currency pairings, you won’t actually get to trading for a long time. Find a pair that you can agree with by studying their risk, reward, and interactions with one another; rather than devoting yourself to what another trader prefers. Keep your trading simple when you first start out.

Use your margin carefully to keep your profits secure. Utilizing margin can exponentially increase your capital. Yet, many people have lost a great deal of profit by using margin in a careless way. Only use margin when you feel your position is extremely stable and the risk of shortfall is low.

Pay special attention to financial news happening regarding the currencies in which you are trading. The speculation that causes currencies to fly or sink is usually caused by reports within the news media. Quick actions are essential to success, so it is helpful to receive email updates and text message alerts about certain current events.

Foreign Exchange Market

Use everything to your advantage in the Foreign Exchange market, including the study of daily and four-hour charts. Le teicneolaíocht an lae inniu, féadfaidh tú gluaiseachtaí mionsonraithe sa mhargadh malairte eachtraí a fháil i gceann 5 nóiméad agus 15 nóiméad. The issue with short-term charts is that they show much more volatility and cloud yoru view of the overall direction of the current trend. By sticking with a longer cycle, you can avoid false excitement or needless stress.

Foreign Exchange is a very serious thing and it should not be taken as a game. People who are delving into Forex just for the fun of it are making a big mistake. Throwing away their money in a casino gambling would be more appropriate.

Remember that on the forex market, up and down patterns will always be present, but there will only be one dominant pattern at a time. Selling signals is not difficult when the market is trending upward. Your goal should be choosing trades based on what is trending.

The popular perception of markers used for stop loss is that they can be seen market wide and prompt currencies to hit the marker level or below before beginning to rise again. It is best to always trade with stop loss markers in place.

In the world of forex, there are many techniques that you have at your disposal to make better trades. The world of forex has a little something for everyone, but what works for one person may not for another. Hopefully, these tips have given you a starting point for your own strategy.

Leave a Comment